2010 Reliability and Service Survey: Smartphone and Wireless Providers

November 30, 2010 Leave a comment

Apple fans love the iPhone, but they’re not particularly thrilled with AT&T, which presently is exclusive iPhone carrier in the United States. A recent study concluded that AT&T was in last in voice call quality and data speed, while Verizon Wireless as the overall favorite.

John Moncure, an iPhone 3G owner in South Carolina, says AT&T’s 3G service is unreliable where he lives. “Sometimes walking from one side of the house to the other–and I live right downtown in the county seat–I lose connectivity,” says Moncure, headmaster of a Montessori school in Camden, a small town of 7000 people.

“I like the iPhone, it’s a good machine. If it were available with all the providers, I would pick the provider that gave me the best service–and I don’t think that’s AT&T, not out here,” he adds.

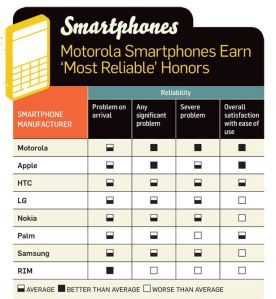

Research In Motion (RIM) should take note that BlackBerry users aren’t a happy lot either. RIM’s widely used smartphone received below-average grades in nearly every reliability and usability category, although BlackBerrys arrive with few out-of-the-box problems. Nearly 1 in 3 BlackBerry users report at least one significant problem with their phone, compared with roughly 1 in 5 Motorola handset users.

RIM has another serious issue to contend with: Younger consumers in their twenties tend to favor phones from Apple, HTC, and vendors that use Google’s Android mobile operating system, according to a recent Yankee Group study. RIM’s demographic skews a little higher–in the 30-plus range–mostly because a BlackBerry “tends to be used a lot in work environments,” says Yankee Group mobile analyst Carl Howe.

T-Mobile deserves kudos for its customer support. While the fourth-place wireless carrier’s overall service rating is very close to its competitors’ scores, the company excels in phone support, readers report. T-Mobile’s average hold time is 4.6 minutes–significantly lower than the others, which have times ranging from 5.2 minutes (AT&T) to 6.1 minutes (Verizon).

And 84 percent of T-Mobile customers report that they’re satisfied with the voice call reliability of the carrier’s network, second only to Verizon’s 86.7 percent. (AT&T was a distant fourth with 72.8 percent, no doubt an indication of the dropped-call problems many iPhone users have reported.) Also, note that Motorola takes the honors in phone reliability.

(Statistics gained from PC World)